RevFund

We are an impact-first seed fund. Our goal is to raise funds to invest in for-profit, scalable social enterprises based in California and offering potential for global impact.

Quick Links

Our mission is to support your mission.

RevFund is raising capital to invest in social enterprises focused on global impact.

We use a combination of traditional capital and venture philanthropy to invest in for-profit, early-stage startups with a double bottom line for purpose and profit.

RevFund is committed to supporting missions for social good – whether you’re an impact-first company looking for a partner with more than just investment capital, or an investor who wants to make a difference.

We are backed by the track record of RevHub, an incubator for sustainable and scalable for-profit businesses and a leader in impact ecosystem building. Get in touch today to let us know how RevFund can support your mission.

Applications Currently Closed.

Thank you for your interest in RevFund. While we are not currently accepting new applications, the fund remains active in supporting our existing portfolio and advancing our mission. Please check back for future opportunities, or subscribe to our newsletter for updates.

RevHub’s Social Impact Fund (RevFund) was selected as an Emerging Impact Manager (EIM) for the ImpactAssets 50™ 2024 (IA 50) for our unique strategies, under-represented impact themes, and diversity in leadership.

What we look for:

Clear social-impact mission

A defined objective with a measurable and replicable/scalable impact and robust, financially sustainable business model.

Proven product/market fit

Protectable IP

A unique, defensible IP or model that can sustain its competitive advantage.

Viable company structure

Preferably a two-founder team, with at least one founder working on the start-up full time.

Focus within local sectors

Applicable to the vertical of Climate Impact, with which SoCal has established ecosystems.

Target Initial

Investment:

$50 – 100k

Investment Framework + Terms

- Reserve for follow-on: As appropriate

- Maximum total investment: $1M

- Structure: Convertible note

- Lead preferred

- Co-investment rights secured

- Term: 10 years + 2 one-year extension options

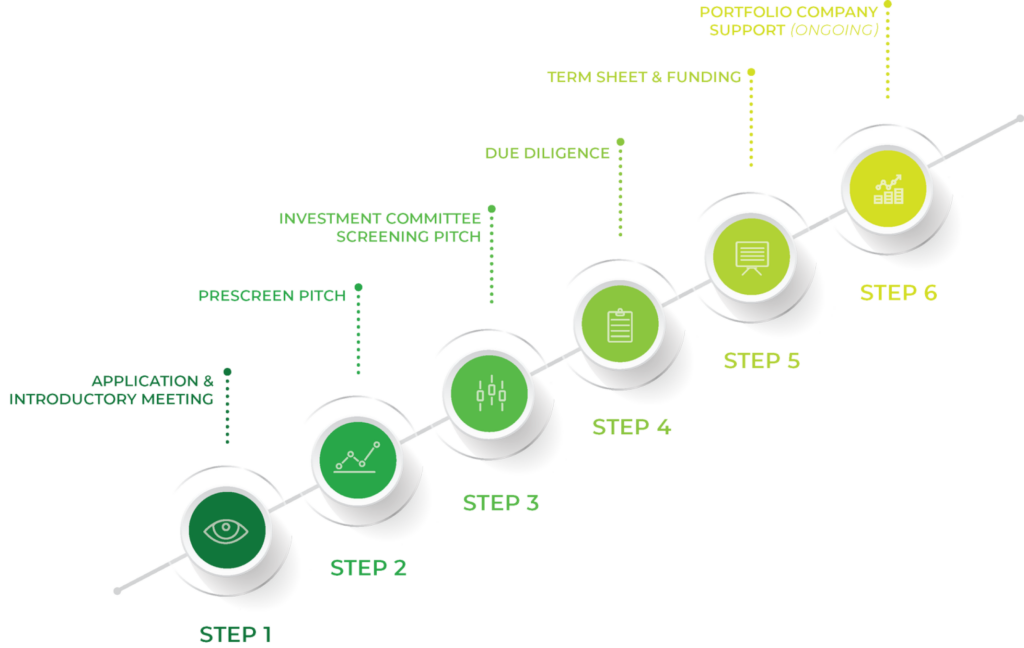

Investment Process

Our approach to impact reporting

As an impact fund, RevHub is committed to diligently measuring and reporting impact across our portfolio. This isn’t just to make informed decisions and meet investor expectations, but to ensure our objectives are backed by hard data. Recognizing that early-stage ventures might lack data, we advise them to adopt impact models. These models, akin to financial ones, can start with estimates and be refined over time.

By integrating impact models, companies not only fortify fundraising and sales but also uphold brand integrity. We’ve collaborated with ImpactableX, a platform tailor-made for startups. With ImpactableX, companies can develop impact models, align metrics with global standards, and gain profound AI-powered insights. These insights empower us to achieve both substantial financial returns and tangible impact value.

Why impact matters + how it can drive growth

Innovations that avert detrimental outcomes or propel positive ones, especially for marginalized groups or resources, inherently have tremendous value. However, revenue might only represent a fragment of this value, often overlooking broader benefits for the community.

By holistically accounting for outcomes and incorporating impact into financial analyses, we make better investment choices. Impact modeling isn’t just a measurement tool; it’s a growth strategy. Proper metrics can enhance sales, foster enduring partnerships, and distinguish your brand. Whether it’s showcasing potential impact for fundraising, leveraging data for sales, ensuring brand credibility, or streamlining operations, ImpactableX can be a crucial ally. As part of our collaboration, companies are expected to keep their reporting consistent and can opt to use ImpactableX for a seamless experience.

Portfolio

Frequently Asked Questions (FAQ)

From application to investment approval, the timeline can vary, but we try to complete all steps through diligence within 60 days. The length of time to deal close and funding depends on the individual company and the terms negotiated.

Impact companies address one or more of the UN Sustainable Development Goals (UNSDGs). They have both a financial model AND an impact model. The impact model values the environmental and/or human impact the company generates in dollar or numeric terms. If you participate(d) in an incubator cohort with RevHubOC, you will create an impact model.

We focus on sustainable, for-profit ventures based in California that create Climate Impact. This means companies that solve climate-related problems related to six traditional industry verticals – mobility and transport; energy; built environment; financial services; food, agriculture and land use; and industry, manufacturing, and resource management. This also extends to companies related to two cross-cutting horizontals – CHG capture, removal, and storage; and climate change management and reporting.

Please see our section on How to Apply. Keep in mind that we will not set an initial meeting unless you have financials and a pro forma included in your pitch deck. You should also have an Impact Slide including UNSDG’s your solution addresses. We cannot move you forward to Prescreen or Screening without these slides.